Clover lets merchants accept Apple Pay, Google Pay and Samsung Pay. Our pick is Clover (see our full review of Clover). The best credit card processors allow merchants to accept one or more digital payment methods in addition to credit cards. If you’re a small business that wants to accept digital wallet payments, you’ll need to ensure your credit card processor supports them. You must have a Samsung device to use it.You can use Samsung Money as a bank account and earn interest.It can be used with non-NFC credit card readers.Its user base is growing more slowly than Apple’s.It recently relaunched, requiring users to download a new app and reinstall.It’s much less used than Apple Pay (10.3% of digital wallet in-store purchases).It’s a good option for Android phone users.

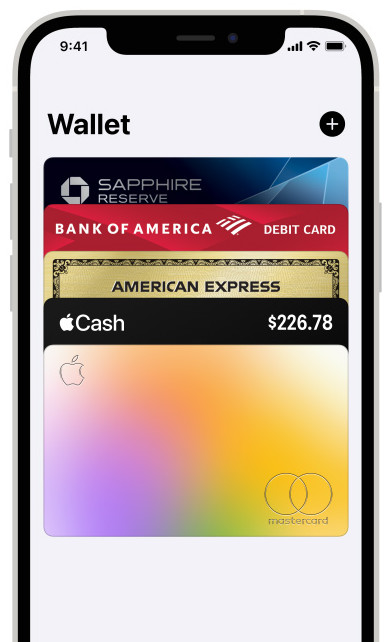

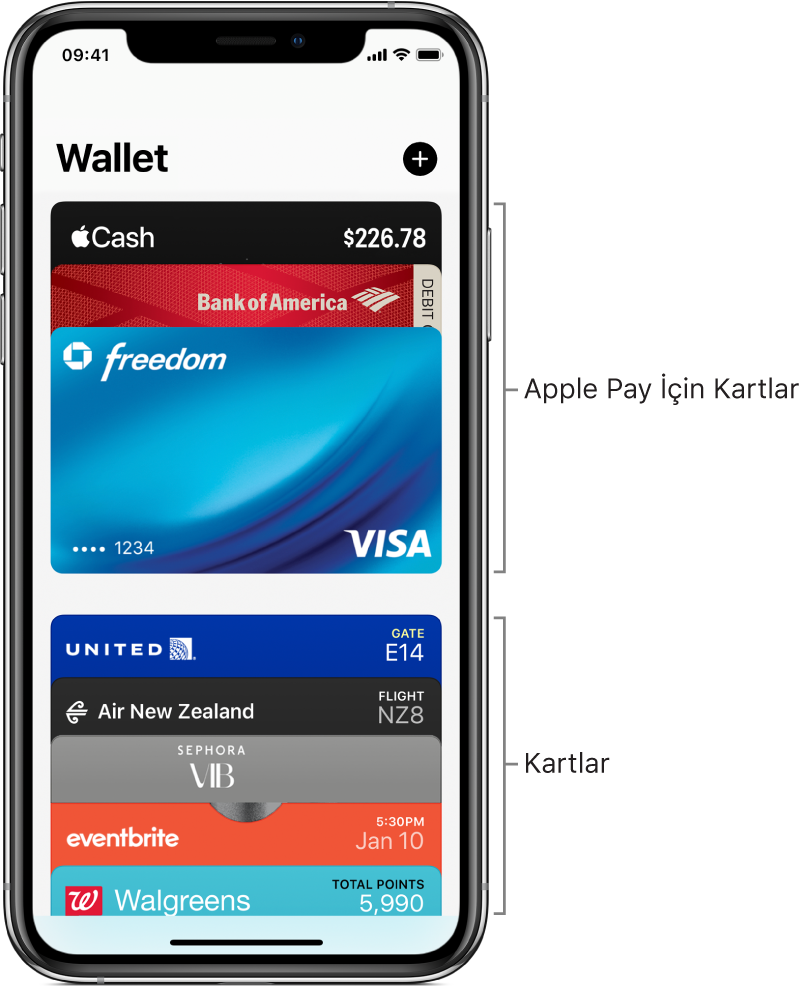

It has the fastest YOY growth in users: 24% from 2020 to 2021.consumers have an Apple Pay-enabled device. merchants accept it (according to Apple). Here’s a comparison of Apple Pay, Google Pay and Samsung Pay. We’ll take a look at the three top mobile wallets, how they work, and what consumers and entrepreneurs can expect in terms of more widespread adoption.ĭid you know? Other online payment apps include Venmo, Cash App and Zelle. Despite slow adoption, the best point-of-sale (POS) systems support these mobile payment platforms as more merchants allow for NFC-enabled payments. While all these platforms serve virtually the same function, each is slightly different, with its strengths and weaknesses. Other options include Chase Pay, MasterCard PayPass, PayPal and Visa Checkout. But which app should you use? What’s the best mobile payment app?Īpple Pay, Google Pay and Samsung Pay are popular options compatible with many merchant card readers, credit cards and banks. It’s easy to pull out your phone when you’re in the checkout line and tap to pay your bill. Today’s mobile payment platforms streamline transactions for consumers by combining cash, credit cards, debit cards and gift cards in one mobile application.

0 kommentar(er)

0 kommentar(er)